Massachusetts Hard Money Lender

Rates Starting at 10%

West Forest Capital is a Massachusetts hard money lender, financing real estate investments up to $3 million. We have gained a reputation as the fastest hard money lender in Massachusetts because we know how critical each day is in Massachusetts’ competitive real estate market.

- We are a direct lender, not a broker

- Same day pre-approval

- Funding in 3-5 days, although 1 day is possible

- Loan amounts up to $5 million

Property Types

- Multi-family

- Single-family Investment Properties

- Condominiums

- Retail

- Office Buildings

- Industrial & Warehouse

- Hotels & Motels

- Special Purpose & Mixed Use

- Parking Garages & Lots

- Land

Lending Parameters

| Loan Size | $100,000 to $5,000,000 |

| LTC | Up to 80% of purchase price |

| Rehab Funding | 100% |

| LTV | Up to 70% of the ARV |

| Term | Standard is 12 months. 24-36 months is available |

| Lien | First lien; second lien as additional collateral only |

| Interest Rate | 10%–12.5% |

| Points | 1.5–2% of the loan amount |

Counties Covered

West Forest Capital lends in the following counties in Massachusetts:

Recently Funded Hard Money Loans in Massachusetts

Medway, MA

- Location: Medway, MA

- Original Purchase: $225,000

- Current Value: $290,000

- Loan Amount: $200,000

- Exit Strategy: Refinance

- Investor Capital: $25,000

- Equity Created: $65,000

- Investor Return on Capital: 160%

This Massachusetts hard money loan was a cash-out refi, the proceeds of which were used by our client to build-out ancillary commercial space that is owned by our client in the same building. The subject property, a residential condo, was purchased for $225,000 and appreciated to $290,000. Utilizing a hard money loan in Medway, MA we were able to provide a cash-out $200,000 loan at 78% LTV by including the commercial space as additional collateral. The borrower was able to pull the vast majority of his investment out of the property, leaving only $25,000 in the deal, and generating a 160% return. Our loan was later refinanced by a traditional bank.

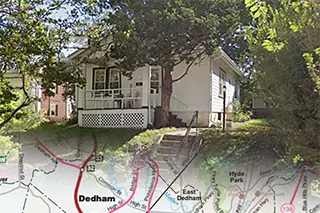

Dedham, MA

- Location: Dedham, MA

- Purchase Price: $412,000

- Rehab Budget: $47,000

-

Loan Amount: $288,400 at Closing

+ $47,000 Rehab = $335,400 - ARV: $565,000

- Exit Strategy: Sale

- Investor Capital: $123,600

- Equity Created: $106,000

- Investor Return on Capital: 86%

This Boston area hard money loan was used to fix and flip a single-family house. The home was purchased after several rounds of negotiations and needed a new kitchen, bathrooms, and various cosmetic touch-ups. We provided 70% of the purchase price and 100% of the rehab costs. Our client, who had completed two other flips in the previous three years, was able to move through the project quickly. Within 4 months the entire rehab had been completed and the property was listed for sale. Demand was strong, and the property went into contact within three weeks of the listing date. Two months later, the property was sold and our loan repaid.

Boston, MA

- Location: Boston, MA

- Purchase Price: $1,370,000

- Rehab Budget: Not required

- Loan Amount: $890,500

- Exit Strategy: Refinance

- Investor Capital: $479,500

- Equity Created: $150,000

- Investor Return on Capital: 31.3%

This hard money loan was made to a foreign national purchasing a two-bedroom condo in the Back Bay neighborhood. With a light credit history and no US income, our client was not eligible for a traditional bank loan for this investment property. However, the client was able to put down a 35% down payment, and we utilized a Boston hard money loan to fund the remaining 65%. This loan also included a 6-month interest reserve. The property needed no rehab and was quickly rented out. After demonstrating 9 months of rental history, our client was able to refinance our loan into a long-term fixed DSCR loan.

Why Use a Hard Money Loan

- If you need funding fast. While a typical bank may take months to review your loan application, West Forest Capital offers same day hard money loan approval, and funding within 3-5 days. In an emergency situation, we can even fund in 1 day!

- If the property isn’t stabilized. Sometimes, it’s not a question of time, but it’s the actual property that a traditional bank won’t finance. Examples include a property that requires rehab, missing a Certificate of Occupancy (CO), or does not have a strong rental history. Hard money lenders such as West Forest Capital will be able to fund the property when a bank can’t.

- If you have poor credit. West Forest capital understands that events that negatively influence one’s credit score can happen from time to time. Therefore, we mostly consider the value of the property, rather than FICO score or debt-to-income ratios when considering funding a loan.

- If you don’t want to take a loan in your personal name. A traditional bank is likely to require that a property is owned directly by an individual they are making the loan to. If you would like to own the property in an LLC, or if you own too many properties for a bank to finance you personally, a hard money loan is a great option.

Why Choose A Massachusetts Hard Money Lender

We love Massachusetts and are proud to be a Boston area hard money lender! We are very familiar with the vibe of Back Bay, history of Beacon Hill, and the energy of the Seaport. You won’t need to explain to us that Somerville, Cambridge, and Jamaica plain have seen vast price appreciation in recent years. If you need a hard money loan in the Boston area suburbs – Ashland, Brookline, Framingham, Newton – you name it, we are right here to help you secure funding.

But we don’t stop there. If you’re looking for a hard money loan in Cape Cod, there’s great news: we provide hard money loans on the cape too! So if you’re looking to flip a property in Hyannis, Falmouth, Brewster, Chatham, Dennis, Orleans (there are a lot of towns aren’t there?) rest assured you’ll get the funding you need.

Financing your Massachusetts Investment Property

Bucking nationwide trends of movement away from northern states, Massachusetts has grown substantially in population and economic prosperity in the last several years. Many healthcare, technology, and financial services companies are located MA and take advantage of the highly educated population originating from the vast supply of colleges and universities in the area.

Massachusetts offers real estate value stability, while allowing for appreciation upside due to the population growth in many areas surrounding the city of Boston.

Asset-backed Lender Focused on Customized Solutions

With our knowledge of the Massachusetts fix and flip market, West Forest Capital is able to structure creative transactions that fit your hard money financing needs. We fund loans based on the value of the asset so in some cases we were even able to finance more than 100% of the purchase price and rehab amount.

West Forest Capital also offers the longest hard money loan available on the market (3 years), ideal for buy and hold investors.

Give us a call or apply for a loan today!

Borrower interview

Interview with our client, Mike, in Massachusetts

Listen to our interview with Mike, a software engineer from Massachusetts, who started in real estate to provide himself with some passive income.