Hard Money Lenders Florida

Rates Starting at 10%

West Forest Capital is a Florida hard money lender, financing real estate investments up to $3 million. We have gained a reputation as the fastest hard money lender in Florida because we know how critical each day is in Florida’s competitive real estate market.

- We are a direct lender, not a broker

- Same day pre-approval

- Funding in 3-5 days, although 1 day is possible

- Loan amounts up to $5 million

Property Types

- Multi-family

- Single-family Investment Properties

- Condominiums

- Retail

- Office Buildings

- Industrial & Warehouse

- Hotels & Motels

- Special Purpose & Mixed Use

- Parking Garages & Lots

- Land

Lending Parameters

| Loan Size | $100,000 to $5,000,000 |

| LTC | Up to 80% of purchase price |

| Rehab Funding | 100% |

| LTV | Up to 70% of the ARV |

| Term | Standard is 12 months. 24-36 months is available |

| Lien | First lien; second lien as additional collateral only |

| Interest Rate | 10%–12.5% |

| Points | 1.5–2% of the loan amount |

Counties Covered

West Forest Capital lends in the following counties in Florida:

Recently Funded Hard Money Loans in Florida

Naples, FL

- Location: Naples, FL

- Original Purchase: $1,950,000

- Rehab Budget: Not Required

- Loan Amount: $1,400,000

- Exit Strategy: Paydown

- Investor Capital: $550,000

- Equity Created: $62,500

- Investor Return on Capital: 11,4%

We made a Florida hard money loan to a client who purchased a three-bedroom, three-bathroom condo in a sought after building in Naples, Florida. Our client’s strategy was to generate returns by using the property for seasonal and short-term Airbnb rentals, which would generate higher ROIs vs. an annual lease. We provided a hard money loan of 71.8% of the purchase price, and our client self-funded light rehab, mostly cosmetic in nature. Our client repaid our loan with a paydown generated from the sale of another property. At the time of paydown, the property experienced appreciation of nearly $63k.

Boynton Beach, FL

- Location: Boynton Beach, FL

- Purchase Price: $437,500

- Rehab Budget: $55,000

-

Loan Amount: $339,000 at Closing

+ $55,000 Rehab = $394,000 - ARV: $570,000

- Exit Strategy: Sale

- Investor Capital: $98,438

- Equity Created: $87,500

- Investor Return on Capital: 89%

Our client obtained a Palm Beach County hard money loan in Boynton Beach to booster his offer for the property which beat out several other offers with conventional financing. After the needed repairs were completed, the exit strategy was flexible: either a sale or a conventional refinancing once the property was stabilized and rented. Ultimately, our client came across another fix and flip opportunity and elected to sell the rehabbed original property to raise cash for a down payment on the next deal.

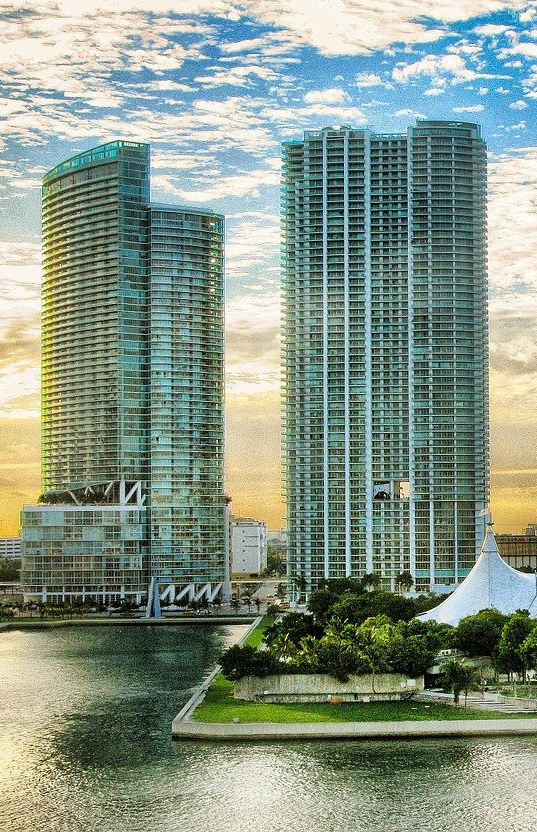

Miami, FL

- Location: Miami, FL

- Purchase Price: $750,000

- Rehab Budget: $110,000

- Loan Amount: $543,750 at Closing + $110,000 Rehab = $643,750

- After Repair Value: $1,125,000

- Exit Strategy: Refinance

- Investor Capital: $206,250

- Equity Created: $265,000

- Investor Return on Capital: 128.4%

Why Use a Hard Money Loan

- If you need funding fast. While a typical bank may take months to review your loan application, West Forest Capital offers same day hard money loan approval, and funding within 3-5 days. In an emergency situation, we can even fund in 1 day!

- If the property isn’t stabilized. Sometimes, it’s not a question of time, but it’s the actual property that a traditional bank won’t finance. Examples include a property that requires rehab, missing a Certificate of Occupancy (CO), or does not have a strong rental history. Hard money lenders such as West Forest Capital will be able to fund the property when a bank can’t.

- If you have poor credit. West Forest capital understands that events that negatively influence one’s credit score can happen from time to time. Therefore, we mostly consider the value of the property, rather than FICO score or debt-to-income ratios when considering funding a loan.

- If you don’t want to take a loan in your personal name. A traditional bank is likely to require that a property is owned directly by an individual they are making the loan to. If you would like to own the property in an LLC, or if you own too many properties for a bank to finance you personally, a hard money loan is a great option.

Why Choose A Florida Hard Money Lender

We are a Florida hard money lender focusing on Southeast Florida, the Tampa area, and the Orlando area. However, we do make hard money loans in other areas of the state on a case-by-case basis.

Specifically in South Florida, we offer the fastest service and low hard money rates in Miami (including South Beach and North Miami Beach), Fort Lauderdale, West Palm Beach, and in between. The area is still growing rapidly, and in this competitive market, we want to make sure your real estate investments are funded fast! If you’re looking for a hard money loan in Doral, Miramar, Hollywood, Pompano Beach, Boca Raton, Del Ray Beach, Palm Springs – or anywhere in the vicinity – reach out to us. We are here to help.

Financing your Florida Investment Property

Florida is one the fastest growing states by population in the country. Due to the size of the state, there is a large variability between urban and rural areas. The southeast area of the state has historically been the most cosmopolitan, attracting a broad, internationally-linked economy in addition to the strong tourism industry in place.

However, the state’s popularity has broadened the population trends. Now, the suburbs in the Tampa and Orland areas – Kissimmee and St. Cloud, for example, are attracting substantial business development, driving further population growth, and a host of opportunities for fix and flip projects as well as increased rents for existing single family homes, condos, and multi-family developments.

The best way to secure deals in this market is to buy value add real estate or move very quickly when presenting an offer. In both cases, our Florida hard money loan program is the perfect fit.

Asset-backed Lender Focused on Customized Solutions

Our expertise is lending hard money loans on Florida real estate investment properties. As such, West Forest Capital is able to structure creative transactions that fit your hard money financing needs. We fund loan directly, so there is no red tape. We also fund loans based on the value of the asset, which means that in some cases where the property is bought significantly below market value, we are able to finance 100% of the purchase price and rehab amount. And if you need a cash-out refinancing, we are also here to help.

In addition to our standard 1 year loan, West Forest Capital also offers the longest hard money loan available on the market (3 years), ideal for real estate investors who need more time to stabalize their property.

Give us a call to discuss your loan scenario. You’ll get immediate feedback on LTV and rate.

Frequently Asked Questions about Florida Hard Money Loans:

What are hard money lenders?

A hard money lender is a form of financing that real estate investors use to complete a purchase or cash-out refi transaction – the loan is collateralized by the subject property and funded by private lenders based on the value of that property.

Traditional bank loans are typically approved using common criteria such as the prospective borrower’s FICO score, qualitative credit history, debt to income ratio, and other factors. But hard money lenders base the decision on the value of the asset in question and should the borrower fail to pay back the loan, that asset can be foreclosed on. Private money loans can be used to purchase both commercial and residential properties.

How do hard money loans work?

Hard money loans differ from traditional loans made by a bank or conventional financing institution. These are often short-term funding arrangements where a real estate investor is in need of quick financing to close a real estate transaction in which time is of the essence.

Furthermore, hard money loans can be approved and funded much faster than loans with traditional banks, so the borrower can have the available cash needed to purchase an investment property in a matter of days. This often benefits borrowers in competitive situations, and in fact, offers utilizing hard money loans are often viewed as good as “cash offers” by sellers.

On the other hand, a conventional financing institution can take months for a loan officer to receive all the documents needed, review the request, approve the borrower’s application as complete, process that application, and fund the loan. This is all without a guarantee that the loan will even close! Too many times loans are turned down last minute as they go through the approval chain! Not so with a hard money loan: your loan will be approved rapidly, a commitment letter issued, and you will be funded within 2 weeks.

Since hard money loan programs are asset-based, the terms of the loan are often shorter than traditional loans from conventional banks and lenders. These types of loans can also be available without prepayment penalties attached.

What do hard money lenders look for?

A borrower’s credit score and history, and a borrower’s liquidity (cash or stocks/bond holdings) are factored into a decision to approve or deny a hard money loan. However, they play a far less important role by comparison to the value of the asset that is being purchased with the funds. Some level of experience with real estate is also looked at favorably, but not required.

What is required is a strong execution plan: whether that’s fix and flip, refinancing, partner buy-out, etc. The lender must be comfortable with how you plan to pay off the loan.

What is hard money used for?

Hard money loans can be used for a variety of purposes, although most borrowers will use hard money for property purchases when quick financing is necessary. Hard money is sometimes referred to as a bridge loan as it bridges the gap between the time of the purchase of the asset and the time when the property is stabilized (fixed-up / rented) or sold.

Hard money lenders often work with Florida real estate developers who are embarking on construction projects or Florida real estate investors who plan to buy an investment property that requires repairs or renovations. These are often called fix and flip loans. Traditional lenders typically do not lend on properties that need substantial renovations, and hence, many investors rely on hard money lenders for these loans.