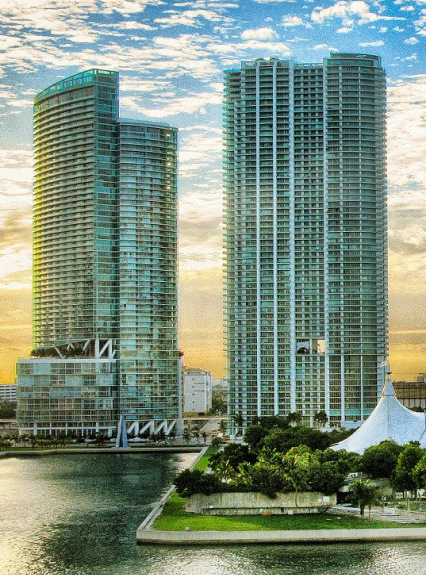

Hard Money Lender Miami-Dade County

Ask about our low rates

As a Miami-Dade County hard money lender, West Forest Capital provides financing options for real estate investments reaching up to $3 million. Renowned as the quickest hard money lender in Florida, we recognize the time-critical nature of Miami-Dade County’s dynamic real estate market, prioritizing rapid processing for our clients.

- We are a direct lender, not a broker

- Same day pre-approval

- Funding in 3-5 days, although 1 day is possible

- Loan amounts up to $5 million

Property Types

- Multi-family

- Single-family Investment Properties

- Condominiums

- Retail

- Office Buildings

- Industrial & Warehouse

- Hotels & Motels

- Special Purpose & Mixed Use

- Parking Garages & Lots

- Land

Lending Parameters

| Loan Size | $100,000 - $3,000,000 |

| Loan to Value | Up to 80% |

| Primary Residence | Not accepted |

| Rental status | Rented preferred but not required (can use market rents) |

| Term | Up to 30 years |

| Format | Fixed or Variable available |

| Rate | Varies by product, correlation with Treasury Rates |

| Points | Typically 2% |

Towns Covered

- Broward County

- Collier County

- Duval County

- Hillsborough County

- Martin County

- Miami-Dade County

- Orange County

- Palm Beach County

- Pinellas County

- Volusia County

Palm Beach Gardens, FL

West Palm Beach, FL

Boynton Beach, FL

Why Use a Hard Money Loan

- In critical situations, the lengthy loan review process at traditional banks is simply too slow. West Forest Capital offers same-day approval for hard money loans in Palm Beach, with funding usually processed within 3-5 days. For urgent needs, we can expedite funding in just 1 day!

- When a property isn’t stabilized, traditional banks might decline financing due to reasons like the need for rehabilitation, absence of a Certificate of Occupancy (CO), or insufficient rental history. However, hard money lenders in West Palm Beach, such as West Forest Capital, are equipped to provide funding for such real estate properties when banks cannot.

- If your credit isn’t ideal, don’t worry. At West Forest Capital, we understand that circumstances can affect credit scores. That’s why we emphasize the property’s value over FICO scores or debt-to-income ratios when determining loan eligibility.

- If you prefer not to take out a loan in your personal name, traditional banks typically require the real property to be owned directly by the individual borrowing the loan. Opting to own the property through an LLC or owning too many properties for conventional financing are situations where a hard money loan in Palm Beach becomes a viable option.

Why Choose a Miami-Dade County Hard Money Lender

As a hard money lender in Miami-Dade County, we prioritize smooth transactions and prompt assistance. With an extensive understanding of Miami-Dade County, from Hollywood to Deerfield Beach, encompassing Fort Lauderdale and Pompano Beach, navigating the region is second nature to us. Our proven track record includes successful private money real estate loans in Miramar, Pembroke Pines, Tamarac, Margate, and numerous other neighboring cities and towns. Additionally, our proficiency extends to suburban areas like Davie, Weston, Sunrise, and Coral Springs, enabling us to finance real estate investment properties across Miami-Dade County effortlessly.

Our lending portfolio features both private money and hard money loans tailored for all property types within Miami-Dade County. Whether you’re in search of a fix and flip lender or require funding for a mixed-use, commercial, or industrial property, we are fully equipped to meet your financial requirements in Miami-Dade County.

Recent market dynamics indicate a notable surge in activity in Coconut Creek, Plantation, and Parkland. Leveraging our comprehensive knowledge of these areas, we excel in financing complex commercial properties, providing assistance in distressed situations, and offering financing solutions for Airbnb properties.

Financing your Miami-Dade County Investment Property

The demographic landscape of Miami-Dade County is flourishing, leading to an economic diversification beyond its traditional tourism sector. Today, tech ventures, medical institutions, and educational entities contribute heavily to the region’s economy. Broward’s advantageous location serves the needs of daily commuters within the expansive South Florida metro area. With a range of urban centers and quaint towns, the County offers versatile living options, solidifying its status as a sought-after real estate hub.

Asset-backed Lender Focused on Customized Solutions

At West Forest Capital, we utilize our in-depth market knowledge of Miami-Dade County to offer hard money loans that harness our private capital resources. By assessing the asset’s value, we are sometimes able to extend financing that fully addresses the purchase and renovation of properties.

We feature the market’s longest-ever hard money loan duration of three years, which is particularly beneficial for investors looking for prolonged stabilization phases of their properties and those who need a solution that falls between traditional short-term and long-term financing.

Please contact us to discuss your real estate investment strategies in Miami-Dade County. Our services cater to both property owners and brokers, facilitating successful collaborations.

Frequently Asked Questions

What are hard money lenders?

Hard money lenders, distinct from traditional banks, are non-bank asset-based lenders. They prioritize the property’s value over the borrower’s qualifications, resulting in a quicker underwriting process and faster loan funding, often within a week. This expedited process contrasts with the lengthier timelines associated with traditional bank loans, which can take 2-3 months or more. Consequently, real estate investors, particularly those acquiring foreclosed properties at auctions, frequently choose hard money lenders to facilitate the swift closing required by auction terms.

It’s essential to recognize that hard money lenders exclusively lend on investment real estate and do not provide mortgages for residential purposes. Properties financed by hard money lenders are designated for investment use and cannot be occupied as primary residences.

How do hard money loans work?

With hard money loans, borrowers enjoy the advantage of faster approval and funding compared to conventional bank mortgages, but with interest rates ranging from 9-12% due to the increased ease of obtaining these loans. Origination points tend to fall between 1 to 3 and are settled at closing. These loans typically have a short lifecycle of one or two years and are disbursed in two main phases: the initial funding that covers between 70-85% of the property’s acquisition cost, and the renovation financing, which potentially covers 100% of refurbishment expenses. Note that renovation financing is only provided if there is a need, and the disbursement follows the completion of work stages. For instance, if the renovation budget is $50,000 and the borrower finishes $15,000 worth of renovation, the lender will release $15,000 and continue to do so in stages. To ensure the loan remains safe, hard money lenders cap the final total loan allocation at 65% of the property’s value post-renovation or the ARV.

What do hard money lenders look for?

Commercial entities, such as LLCs, are the exclusive beneficiaries of hard money loans due to their classification as commercial loans. Individuals seeking such financing need not fret—with minimal fuss, one can establish an LLC, even singlehandedly.

Lenders specializing in hard money loans take into account the asset’s purchase price along with its After Repair Value (ARV) to ensure a secure return on the funds lent. Acquiring a property at or beneath the market rate is vital for loan approval. Furthermore, if the loan encompasses renovation costs, the lender will diligently monitor that the refurbishment adheres to the pre-set schedule. Clean title status is mandatory; any legal encumbrances such as liens must be resolved before the funds are released.

The lender’s objective is synonymous with their client’s—pursuing a lucrative investment venture. Thereby ensuring that the ARV is considerable enough to cover all expenses while still yielding a profitable margin for the investor.

What is hard money used for?

A hard money loan is typically utilized in the following situations:

- Repair and sell (“fix and flip”): Targeting properties for repair and resale, especially when overlooked by traditional banks due to various issues.

- Upgrade to lease: Acquiring and updating properties that don’t qualify for bank funding with plans to refinance post-leasing.

- Quick purchase execution: Bridging the time gap of lengthy bank processing for urgent property deals like auctions with prompt lending.

- Immediate refinancing: Utilizing owned properties for fast-track cash-out refinancing.

- Purchasing through an LLC: Offering solutions when buying property in an LLC to overcome typical banking hurdles.